Empower your financial ecosystem with intelligent payment systems, data-driven insights, and advanced security — enabling faster transactions, personalized services, and a seamless digital banking experience.

ByteChrome delivers next-generation Fintech solutions — from secure digital banking and payment automation to AI-powered fraud prevention and real-time financial analytics.

Unlock smarter decisions with AI models that analyze financial patterns, detect anomalies, and provide real-time investment and portfolio insights for better financial outcomes.

Streamline complex transactions with intelligent automation that ensures fast, accurate, and secure payments — reducing manual effort and operational costs.

Safeguard financial data with multi-layered encryption, identity verification, and AI-based threat detection to prevent fraud and ensure compliance with global regulations.

The Fintech landscape faces rapid transformation — balancing innovation, data security, and regulatory compliance while maintaining trust and seamless customer experience.

Meeting strict financial regulations like GDPR, PCI DSS, and KYC while ensuring secure handling of customer data remains a top concern for every Fintech firm.

Preventing fraud in digital transactions requires continuous monitoring, pattern recognition, and advanced AI models that adapt to emerging financial threats.

As financial transactions grow exponentially, ensuring performance, uptime, and scalability is crucial to avoid downtime and ensure reliability across all platforms.

Integrating multiple payment gateways, currencies, and APIs while ensuring transaction transparency is a constant challenge for growing Fintech systems.

With the Fintech industry booming, new entrants and evolving user demands make innovation and differentiation key to staying ahead in the global financial race.

Fintech success depends on transparency and reliability — ensuring smooth onboarding, instant support, and personalized financial journeys builds lasting trust.

ByteChrome revolutionizes the financial ecosystem with intelligent tools that enhance digital banking, detect fraud, automate transactions, and empower data-driven decision-making for modern finance.

Identify and prevent suspicious activities in real-time with advanced machine learning models that analyze user behavior and detect anomalies across transactions.

Leverage AI algorithms to assess borrower credibility using financial patterns and alternative data sources, enabling faster and more accurate loan approvals.

Provide customers with 24/7 intelligent assistance for transactions, account queries, and financial advice through secure conversational AI chatbots.

Streamline repetitive financial processes like reconciliation, reporting, and auditing with AI-driven automation — enhancing accuracy and reducing costs.

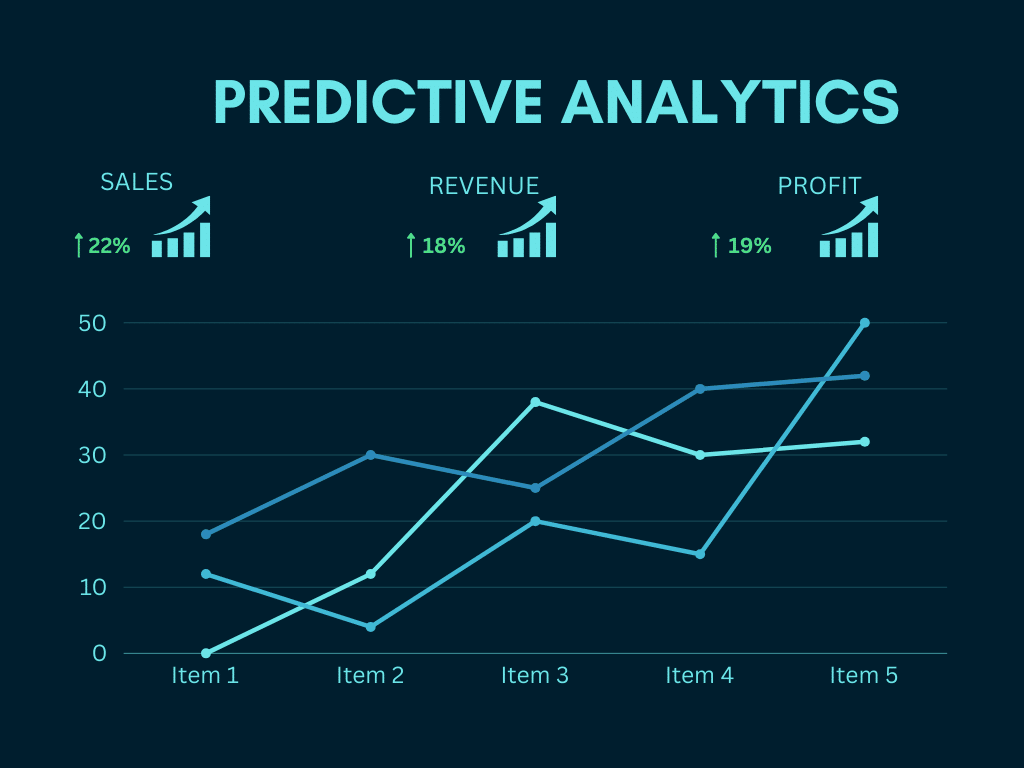

Harness real-time data analytics to forecast financial trends, monitor risks, and make smarter investment decisions using predictive modeling and AI insights.

Protect sensitive financial data with multi-layered AI security systems — encryption, threat intelligence, and fraud prevention built for digital banking.

Explore how ByteChrome’s AI-powered Fintech solutions enhance financial operations, improve customer trust, and enable smarter, data-driven decision-making for banks, investors, and enterprises.

Protect transactions and customer data with AI-driven fraud detection that identifies suspicious activities instantly — reducing risk and ensuring secure financial operations.

Harness machine learning to automate financial reports, track KPIs, and forecast future trends — empowering better investment and budget decisions.

Leverage predictive models to assess creditworthiness, market volatility, and portfolio risks — enabling proactive financial strategies and stable growth.

Simplify and secure global transactions with AI-based payment gateways and automation that reduce errors, speed up settlements, and enhance user trust.

Stay compliant with evolving financial regulations through automated KYC, AML, and auditing systems that ensure transparency and accountability.

Deliver personalized financial solutions and improve client satisfaction using AI-powered analytics that understand customer needs and behavior.

Unlock the power of AI and automation to transform your financial ecosystem. From fraud prevention to smart analytics — achieve faster decisions, stronger compliance, and a secure digital future.

Discover how ByteChrome’s Fintech innovations transform banking, automate finance operations, and ensure secure, compliant, and intelligent digital transactions.